Will Mortgage Rates Drop by 2026 in the UK? Here’s What to Expect

The Current State of Mortgage Rates in the UK

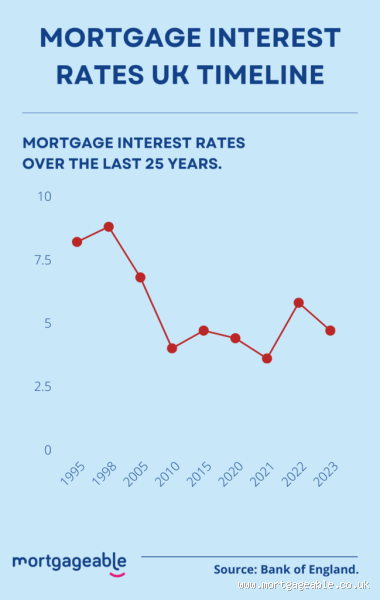

Honestly, if you’ve been keeping an eye on the housing market lately, you’ve probably noticed that mortgage rates in the UK have been rising. Over the past few years, they’ve been climbing due to a variety of economic factors, including inflation and the Bank of England's interest rate hikes. If you're like me, you're probably wondering, will mortgage rates drop by 2026? It’s a valid question, and I’ll break down what we know so far and what might happen in the coming years.

Why Are Mortgage Rates Rising?

So, let’s start with the basics. Mortgage rates in the UK are directly tied to the Bank of England's base interest rate. When the Bank raises its rates, the cost of borrowing increases, which leads to higher mortgage rates. Over the past few years, the Bank of England has raised its base rate to combat inflation, which has had a knock-on effect on mortgage rates.

I was chatting with a colleague, Jane, who recently bought a house, and she said she was "shocked" by how high the rates were. She mentioned that the rate she secured was significantly higher than what her friends got a few years ago. That’s a reality a lot of us are facing, and it’s leaving many wondering if relief will come soon.

Will Mortgage Rates Drop by 2026? The Experts Weigh In

Economic Factors That Could Affect Rates

Honestly, it’s difficult to say for sure, but there are a few factors that could influence whether mortgage rates will drop by 2026. The biggest one is inflation. If inflation continues to decline, the Bank of England might have room to reduce its interest rates, which could lead to lower mortgage rates. However, this is all very much dependent on how the economy performs in the next few years.

In fact, a recent conversation with my financial advisor made me realize just how much of a balancing act it is. He said that if inflation drops steadily and wages grow at a healthy pace, we could see interest rates come down in the next few years. However, if there’s another economic shock, it might delay any rate cuts. So, it’s really a bit of a waiting game.

The Impact of the Housing Market

Another factor to consider is the housing market itself. If demand for homes decreases or if the housing bubble begins to deflate (which some experts believe could happen), it could put pressure on the Bank of England to lower interest rates to stimulate the economy. I know a few friends who have been holding off on buying homes because they’re just not willing to pay these high mortgage rates, and they’re hoping things will cool off by 2026.

However, if the housing market remains strong, the Bank may keep rates higher for longer to prevent the economy from overheating. It’s one of those "double-edged sword" situations where good news for the economy might mean bad news for mortgage rates, at least in the short term.

What Can You Do Now? Prepare for Possible Changes

Fixing Your Mortgage Rate

Well, here’s the thing: if you’re considering buying a house or refinancing your mortgage, locking in a fixed-rate mortgage now might be a good move. Yes, the rates are higher, but they might still be lower than what you’ll see in a few years if inflation continues to remain high. My friend Sarah, who works in real estate, mentioned that a lot of her clients are still locking in fixed rates because they’re afraid of even higher rates down the line.

Stay Informed About the Bank of England’s Decisions

It’s also important to stay informed about the Bank of England’s decisions. The Bank meets regularly to review its base rate, and if inflation shows signs of slowing down, they could start lowering interest rates. Keeping an eye on those decisions can give you a sense of when the rates might start to drop, and whether you should wait or act sooner.

What Will the Housing Market Look Like in 2026?

Predictions for the Housing Market in 2026

Honestly, predicting the future of the housing market and mortgage rates can feel like trying to read tea leaves. However, many economists predict that if inflation slows down and the global economy stabilizes, we could start to see mortgage rates trend downward by 2026.

But, here's the catch – the housing market is unpredictable. There are still many external factors, like global economic conditions, that could drastically change the scenario. One thing we can say for certain is that the next few years will be key for both the economy and the housing market.

The Importance of Financial Planning

In the meantime, the best thing you can do is focus on your financial planning. If you're looking to buy or refinance, make sure your finances are in order. That means saving for a down payment, improving your credit score, and preparing for the potential of rising rates in the short term.

Honestly, it might be tempting to wait until 2026, but it’s crucial to consider how long you’re willing to wait and how much risk you’re comfortable taking on.

Conclusion: Will Mortgage Rates Drop by 2026?

In conclusion, while there’s a chance that mortgage rates could drop by 2026, it’s not a guarantee. Much depends on how inflation behaves, the global economy, and what decisions the Bank of England makes. If you’re planning to buy a home or refinance, make sure to stay informed and keep an eye on both the housing market and interest rates.

If you’re not in a rush, you could wait to see what happens in the coming years. But if you need to act now, consider locking in a fixed-rate mortgage to protect yourself from further rate hikes. It’s a bit of a gamble, but it’s one worth considering.

How much height should a boy have to look attractive?

Well, fellas, worry no more, because a new study has revealed 5ft 8in is the ideal height for a man. Dating app Badoo has revealed the most right-swiped heights based on their users aged 18 to 30.

Is 172 cm good for a man?

Yes it is. Average height of male in India is 166.3 cm (i.e. 5 ft 5.5 inches) while for female it is 152.6 cm (i.e. 5 ft) approximately. So, as far as your question is concerned, aforesaid height is above average in both cases.

Is 165 cm normal for a 15 year old?

The predicted height for a female, based on your parents heights, is 155 to 165cm. Most 15 year old girls are nearly done growing. I was too. It's a very normal height for a girl.

Is 160 cm too tall for a 12 year old?

How Tall Should a 12 Year Old Be? We can only speak to national average heights here in North America, whereby, a 12 year old girl would be between 137 cm to 162 cm tall (4-1/2 to 5-1/3 feet). A 12 year old boy should be between 137 cm to 160 cm tall (4-1/2 to 5-1/4 feet).

How tall is a average 15 year old?

Average Height to Weight for Teenage Boys - 13 to 20 Years

| Male Teens: 13 - 20 Years) | ||

|---|---|---|

| 14 Years | 112.0 lb. (50.8 kg) | 64.5" (163.8 cm) |

| 15 Years | 123.5 lb. (56.02 kg) | 67.0" (170.1 cm) |

| 16 Years | 134.0 lb. (60.78 kg) | 68.3" (173.4 cm) |

| 17 Years | 142.0 lb. (64.41 kg) | 69.0" (175.2 cm) |

How to get taller at 18?

Staying physically active is even more essential from childhood to grow and improve overall health. But taking it up even in adulthood can help you add a few inches to your height. Strength-building exercises, yoga, jumping rope, and biking all can help to increase your flexibility and grow a few inches taller.

Is 5.7 a good height for a 15 year old boy?

Generally speaking, the average height for 15 year olds girls is 62.9 inches (or 159.7 cm). On the other hand, teen boys at the age of 15 have a much higher average height, which is 67.0 inches (or 170.1 cm).

Can you grow between 16 and 18?

Most girls stop growing taller by age 14 or 15. However, after their early teenage growth spurt, boys continue gaining height at a gradual pace until around 18. Note that some kids will stop growing earlier and others may keep growing a year or two more.

Can you grow 1 cm after 17?

Even with a healthy diet, most people's height won't increase after age 18 to 20. The graph below shows the rate of growth from birth to age 20. As you can see, the growth lines fall to zero between ages 18 and 20 ( 7 , 8 ). The reason why your height stops increasing is your bones, specifically your growth plates.